Create a Lasting Legacy

Through Your Giving

Further the work you care most about while

meeting your financial, tax, or estate planning objectives.

Fostering ways of living that expand the wellbeing of both people and planet

Transforming human views of life and the world into a vision of interrelatedness, meaning, and cooperation

Promoting holistic approaches in all spheres of human life that nourish the flourishing of all

Would you like to support our member charities with a cash donation?

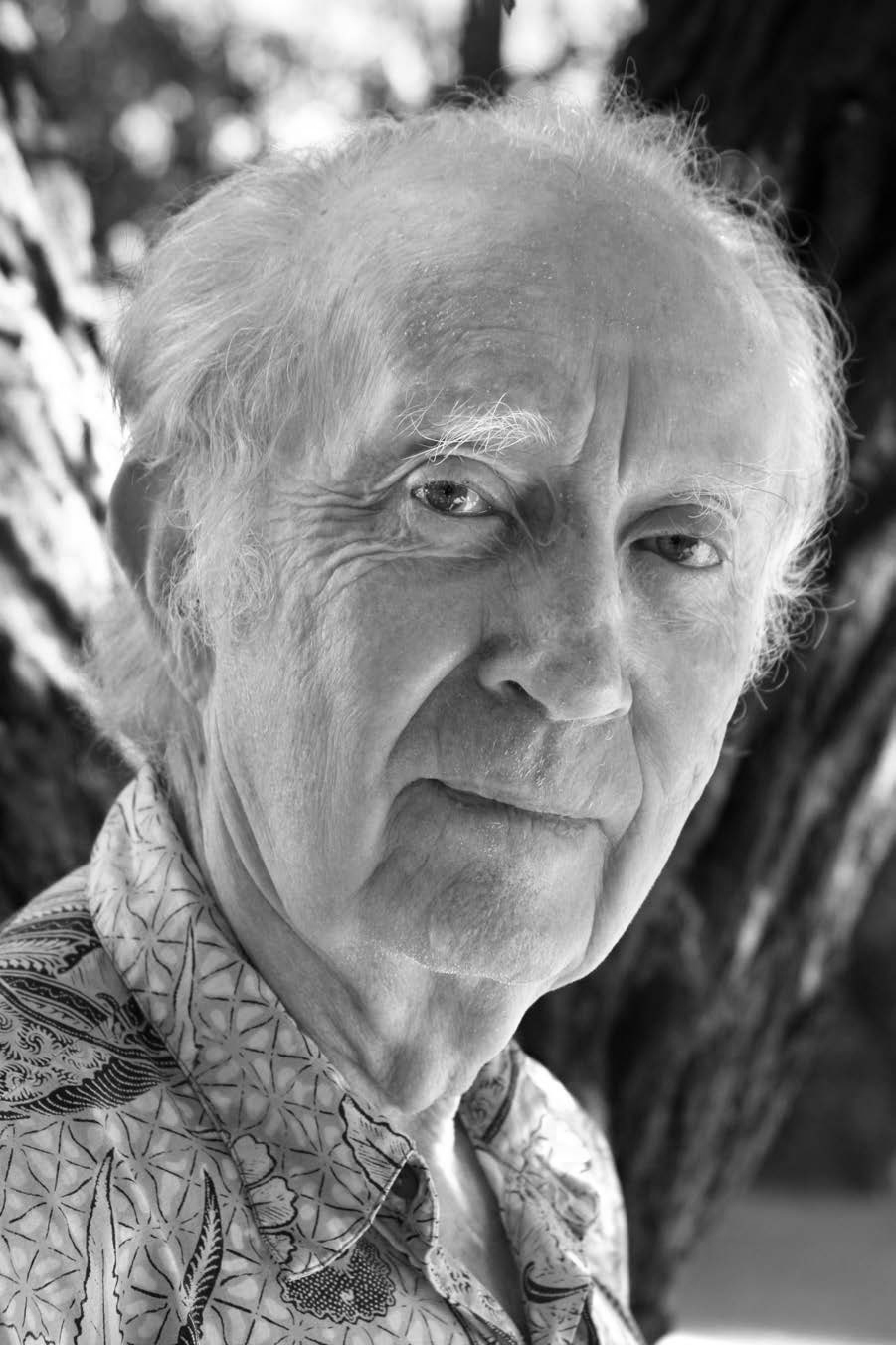

John B. Cobb, Jr., has devoted his life to promoting ways of understanding the world, and our place in it, that help people and planet flourish. The John Cobb Legacy Fund is the Planned Giving Program is a collaborative endeavor of the Center for Process Studies (CPS) and the Institute for Ecological Civilization (EcoCiv) to further the work that Dr. Cobb began and inspired. EcoCiv serves as Trustee of the Fund on behalf of member charities.

Our Founding Charities

Help local leaders develop just and compassionate communities

Educate people about process and relational ways of understanding our cosmos

Advance the dialogue in science and religion

Convene community development toward ecological civilization

Foster interfaith and interspiritual conversations

Develop theological education and resources for faith communities in process-relational ways of understanding matters of ultimate concern

Conduct and promote scholarship to advance understanding of the philosophy of Alfred North Whitehead and put that philosophy to work in the world for the common good